|

Press Releases

Important Merger Announcement

Decision Tree Consulting (DTC) and Understanding & Solutions have merged to form Futuresource Consulting, a major new research and knowledge-based consulting company.

The two companies' complementary services and value systems have come together to form a complete end to end service provider to support you in your research, analysis, strategic planning and decision support. This merger ensures your business has access to the information and insight that will help you to deliver the best possible results.

For more information visit: www.futuresource-consulting.com

8 August 2008

Compact Photo Printers Witness Reduction In Number Of Web Listings On Major Retail Sites in Europe

- The recently released June Compact Photo Printer market volume data shows an increasing volatility in market cyclicity with large one-off' deals with major retailers providing large percentages of market volume

- Analysis of Futuresource's basket of prices tracked within major retailers suggests that retailers are increasingly picking and choosing their specific ranges of compact photo printers according to the best individual deals available at the time.

- According to the Futuresource sample, in January 08 Currys were advertising 7 photo printers on their website; in July 08 this number has reduced to 3.

- In El Corte Ingles this trend is replicated, with 7 models advertised in Jan 08 and now only 2 models in July 08.

8 August 2008

How much will consumers expect to pay for wireless connectivity in Digital Photo Frames?

- In a recent study of 600 Digital Photo Frame purchasers a significant proportion of respondents indicated that they would use WiFi to display images from the internet on their Photo Frame.

- Of these respondents the price premium they would expect to pay for this feature varied greatly.

- Analysing the issue of wireless price premium in the Futuresource weekly price tracker, certain key points become apparent:

- Average prices for non-wireless enabled product across all screen sizes have eroded by just 12% over the past year (July 07 to July 08) , which is low compared with other Consumer Electronics categories.

- However, the average price differential between wireless and non-wireless product s over the same period has reduced from €72 inc Tax (July 07) to €42 inc Tax (July 08).

- It is clear that the price differential is closing because average prices of product s with wireless capability are falling faster than non-wireless products.

- The question is whether price differentials have fallen sufficiently to meet the expectations of consumers (to find out more, please contact Ian Roper ian.roper@futuresource-hq.com).

8 August 2008

14+MP DSLR ASP Witnesses Significant Decline as 10-12MP Segment Remains Stable

- Over the past ten weeks the average selling price for DSLR's has fallen by 2.3% (29 Euros) and is now 1205 Euros (inc. VAT).

- Over the same period last year (between Weeks 22 and 31) the DSLR market's ASP dropped by 5.0% (67 Euros) indicating that the market is more stable this summer.

- In 2008 the DSLR market has witnessed a decline in ASP which has been fuelled by the 10+MP segment, but if this category is segmented further some interesting trends emerge.

- The 10-12MP segment accounts for the most prices picked up within the Futuresource sample by far (59.9% of prices), but this category has remained comparatively stable in terms of ASP over the past ten weeks.

- The average selling price has actually increased by 1.0% (9 Euros) and is now 921 Euros (inc. VAT).

- The Olympus E-410 is a good example of a 10-12MP DSLR that experienced an above average decline over the past ten weeks.

- This model's ASP dropped by 17.2% (92 Euros) from Week 22 and now stands at 442 Euros (inc. VAT).

- The largest decrease in ASP experienced in the DSLR market since Week 22 is found in the 14+MP segment where average prices have fallen by 32.6% (713 Euros).

- There are only a limited number of models in this segment, but demand from consumers for the latest and greatest technology is pulling the prices down.

- The ASP in Week 31 is now 1476 Euros (inc. VAT).

- The largest percentage decrease in this segment was witnessed by the Sony DSLR-A350, with the ASP dropping by 9.2% (69 Euros) to 680 Euros (inc. VAT)

- After the 10-12MP category, the 12-14MP segment accounts for the most prices in the Futuresource sample (21.5%).

- Unlike the more dominant segment, however, the 12-14MP DSLR category has witnessed an above average decline in ASP, although the average price in Week 31 is actually higher than the 14+MP segment.

- One of the reasons behind this is that the 14+MP segment has witnessed launches of three models this year, whilst the bulk of the models in the 12-14MP segment are older products with only one model being released this year.

- This model was the Canon EOS 450D, which has witnessed its ASP drop by 13.3% (101 Euros) to 656 Euros (inc. VAT).

- This segment's ASP is now 1925 Euros in Week 31 after a decrease of 4.7% (96 Euros).

8 August 2008

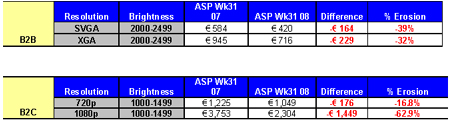

Key SVGA projector segment experiences a 39% price erosion YoY

Year on year price erosion of key specifications within business and consumer markets excluding taxes:

- The SVGA 2000-2499 segment experienced a year on year average price erosion of 39%, with individual prices within this category as low as €278 in the EMEA weekly pricing sample.

- Findings from the recently published Qtr2 08 Projector Market Insight indicate a resurgence in the SVGA category thanks to continued aggressive pricing strategies and other various promotions through retail channels.

- Over a one year period, the key 1080p category witnessed a massive €1,449 ASP reduction. Prices are expected to erode further towards the end of the year as competition intensifies within the HD resolution segment. There are now over eighty 720p/1080p models in the weekly pricing sample compared to sixty models for the same period last year.

- Competitively priced 1080p models from Epson, InFocus, Optoma, Panasonic and Mitsubishi continue to drive prices down within the category.

- The Optoma HD800X is currently the lowest priced 1080p projector within the pricing sample with an ASP of €1270 excluding taxes.

- Home cinema projector customers have shown limited levels of price elasticity in the past, will aggressive 1080p pricing drive sales in 2008?

8 August 2008

High End Mobile Phone Market Heats Up As iPhone Competition Intensifies

- Recent announcements from Sony Ericsson regarding the C905 launch and similar announcements from Samsung regarding the 8MegaPixel i8510 INNOV8 are likely to ensure an interesting sales period leading up to Christmas

- As vendors seek to find differentiation strategies to the iPhone (which appears likely to be available on PAYG by Christmas) expect to see the introduction of more high end models, such as the 8MP camera phones mentioned above, as a result of which we can already see that this is having an interesting impact on market pricing

- Analysis of the Futuresource weekly pricing sample shows that a basket of prices in the above 5MP category has dropped a significant 43% from July 07 to July 08

- As mobile phone makers seek to increasingly high end camera solutions, will the mobile phone increasingly take share from the dedicated camera market?

1 August 2008

Worldwide Flat Panel Market enjoys over 48% YoY growth despite recent economic uncertainty

- The worldwide consumer TV market shrugs off recent economic turbulence to post 54% YoY growth and achieve sales of 23.8 million units. Major sporting events such as the European Football Championships and the Beijing Olympics will certainly have helped stimulate consumer demand and perhaps off-set or mask the real impact of the global credit crunch.

- YoY growth rates of developed markets such as Western Europe and North America still show healthy double digit growth but other areas such as the Middle East and Latin America continue to accelerate with over 200% YoY growth as vendors begin to tap into the market potential.

- The heavy price erosion of Full HD 1080p products continues to drive consumer adoption with this category enjoying 43% quarter on quarter growth and accounting for over 30% of TV sales in Q2 08.

- In terms of screen size the market has made a clear shift toward larger screen sizes but certainly not at the rate that many vendors would hope. The key screen size to see a clear jump in share is the 45-49 category as vendor provide a stepping stone to the ultimately more lucrative 50+ screens.

- The worldwide business market also enjoyed a healthy Q2 08 performance posting YoY growth of 44% and maintaining similar sales volumes to Q1 08 in a period which has been historically slower. Futuresource expected to see the corporate application in particular feel the pinch of the recent economic turbulence with AV budgets typically being the first area to see budget cuts. However, this does not seem to be the case with volume sales seeing little impact. The digital signage market has helped drive growth in the Public Display application with recent examples such as the Gen 2.0 Walmart TV showing that digital signage has the potential to weather economic problems.

- The cross over of TV product into B2B applications continues in earnest with not only channels pushing this product but also vendors making internal changes to become application or end user led and not product led. TV product accounted for over 45% of all B2B sales in Q2 08.

- In contrast to the consumer space, Full HD displays see a slower adoption in the B2B markets with typically more savvy end users appreciating that, at the moment, the price vs. performance trade-off is still firmly in the 720p category. However, vendors have been adding Full HD displays to their line-ups over the past few quarters and it will surely be only a matter of time until the Full HD displays take the majority share.

- LCD technology continues to take share from PDP in the B2B markets, now accounting for 64% of worldwide sales. However, with key vendors such as Panasonic, Samsung and LG still posting healthy PDP results it seems that this technology will not be replaced as rapidly as many expected.

1 August 2008

WW Projector Sales up 20.7% YoY to 1.53mil units in Qtr2 2008

- Volumes sales outperformed expectations in Qtr 2, particularly in EMEA and the Americas where a mixture of a strong education market and a large number of retail deals were key in Q2. The turbulent economic conditions caused by the recent credit crunch and sub-prime lending problems were expected to have more of a negative effect on the market demand.

- Sales in the Americas region hit an all time high with 609k units thanks to the growing education market in the U.S. Latin Americas continues to receive large tenders into lower education.

- EMEA growth varied significantly by country, but it is clearly evident that the retail channel was a key factor for volume growth. Promotions based around the European Football Championship, (many of which were low end SVGA) helped to boost overall volumes this quarter, especially in France, Germany and the Netherlands. Entry level 720p also enjoyed success through retail.

- Russia, Poland and the Middle East provided volume growth in EMEA this quarter through one off large education tenders.

- Further education tenders took place in Malaysia in Qtr 2, helping the overall market to reach 27k units. Mid/Higher brightness products are also a growing market trend in Korea thanks to the booming golf simulation market.

10 July 2008

Voting handset sales had a 20% growth in Quarter 1

- Voting handset sales across the world had a 20% sequential growth on 2007 in Quarter 1

- The Americas had a strong quarter with a 24% sequential growth

- For the first time in USA we observed a growth within the K-12 shares

- UK - Q1 was 19% above forecast and an 8% sequential growth on 2007

- Almost 5 million handsets are forecast in 2008 a 22% volume growth and a value of $200M

DTC have been involved in the Interactive market on a day-to-day basis for over 7 years and Voting Systems for 3 years we analyze the market trends, technologies and products, vendors, applications, and related services.

To find out more about the report please contact Colin Messenger: colin.messenger@futuresource-hq.com

09 July 2008

Full HD displays continue to experience double digit price erosion

- Over the past six months (Weeks 1 27), the ASP for non-DSLR Digital Cameras has witnessed a drop of 20.7% (56 Euros) within the Futuresource sample and is now 214 Euros (inc. VAT).

- Over this time period some key channels such as the Internet have seen significant decreases in ASP, but these declines have been at a slower rate than average.

- The Catalogue/Internet channel has decreased by 20.1% (54 Euros) from Week 1 to reach 215 Euros (inc. VAT) in Week 27.

- Key to this decline are decreases in the ASPs of 8-9MP and 10+MP models.

- The 10+MP segment's ASP has dropped by 46.0% (225 Euros) since the start of the year.

- The ASP of the 8-9MP segment has fallen by 22.0% (55 Euros) from Week 1.

- Less significant channels such as IT Dealers have witnessed the largest decreases in ASP over the past six months.

- With a decline of 30.7% (97 Euros) for non-DSLR Digital Cameras, the IT Dealer channel has experienced the greatest reduction in ASP. In Week 27, the average selling price is 219 Euros (inc. VAT).

- As with the Internet channel, decreases in ASP in the 8-9MP and 10+MP segments have driven this overall decline.

- Due to a very high ASP in Week 1, the 10+MP segment has witnessed a decline in ASP of 62.6% (427 Euros) over the past six months.

- The ASP for 8-9MP segment in this channel has dropped by 21.4% (50 Euros) from Week 1.

- Declines well below average have been experienced by the Supermarket and Department Store channels over the past six months.

- The ASP in the Department Store/Variety Chain/Catalogue Retail channel has dropped by 8.9% (21 Euros) from Week 1, reaching 215 Euros (inc. VAT) in Week 27.

- Although a healthy decline has been witnessed in the 8-9MP segment, the 10+MP segment's decline in ASP has been less dramatic.

- The ASP for the 8-9MP segment has dropped by 23.3% (64 Euros) from Week 1

- The 10+MP segment has witnessed a decline in ASP of 7.4% (22 Euros) over the past six months.

09 July 2008

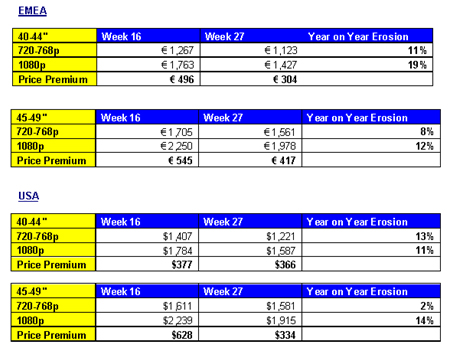

Full HD displays continue to experience double digit price erosion

- Analysis of end user pricing through mainstream retail over a ten week period helps to highlight the difficult trading conditions for vendors and retailers alike.

- The first comparison focuses on price premiums between competing resolutions. In just a ten week period the price premium for 40-44 LCD sets dropped by €192 with Full HD displays on average now only €304 more expensive. The US market has not experienced the same falls in this screen size but importantly the 45-49 LCD category has experienced a drop of $294 with the average premium now only $334. This very much reflects the different stages of screen size adoption between the regions as the US market continues to aggressively migrate to larger screen sizes.

- Unsurprisingly, the price erosion of Full HD sets strongly outpaces HD ready sets with double digit erosion in both screen sizes and also both regions. Again, it is important to reiterate the point that this over a 10 week period in a historically slow season.

- One final important take away is the difference in overall pricing between regions. The price in Euro's often matches the US Dollar price without any currency adjustment. US consumers are clearly enjoying far cheaper display prices.

© DTC Worldwide 1998 - 2007

Privacy Policy

|